Introduction

The following is intended as an updated briefing on a critical matter that will affect our industry from April 2022.

This is an issue that will be on many members’ radars, however we are also aware that, due to the timing, this will come as an unpleasant shock to many more.

The following has been created using the invaluable information and support of Steve Williams and his team at Power Electrics. We have supplemented this data with our own considerations on how to take this issue forward:

What’s Changing? (as written by Power Electrics)

- As of 1st April 2022, most machines, vehicles & appliances will no longer be allowed to use rebated (red) diesel and rebated biofuels

- From this date, the current approach of red diesel being used in any off-road vehicle will end

- Instead, rebated fuel will be limited to certain vehicles, vessels, machines, and appliances for specific purposes

- Those no longer allowed to use rebated fuel will need to switch to fuel on which the full rate of duty has been paid

- Rebated fuels affected by these changes: Red diesel, Hydrotreated Vegetable Oil (HVO), rebated biodiesel, and fuel substitutes

- HVO is a liquid hydrocarbon which is classified for excise purposes as heavy oil and treated the same as diesel

- As of 1st April 2022, only the following sectors remain eligible to use red (rebated) diesel (11p duty per litre instead of 58p)

- Agriculture, forestry, horticulture, and fish-farming

- Rail transport

- Fuel used for non-commercial purposes-heating & power generation

- Community amateur sports clubs (CASC) and golf courses

- Sailing, boating & marine transport (excluding private pleasure craft in Northern Ireland)

- Travelling fairs & circuses

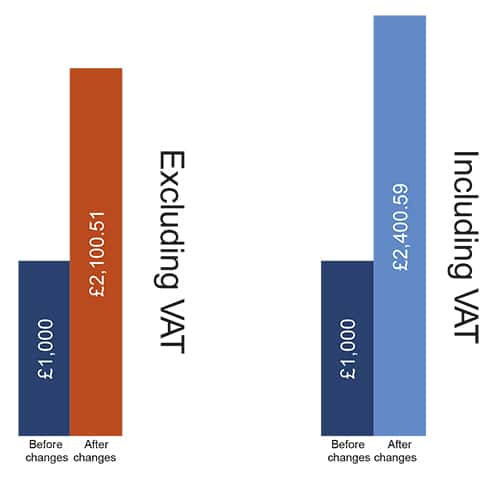

- Businesses losing eligibility will also have to pay 20% VAT as opposed to 5%

What does this mean? (as written by Power Electrics)

- It will be illegal to use red diesel & rebated biofuels in a vehicle or machine that is not entitled to use it

- Those no longer able to use rebated fuel in diesel-powered machines or vehicles will be required to use diesel or biofuel on which the full duty has been paid

- The rebated fuels affected by these changes are rebated red diesel, rebated HVO, rebated biodiesel, bio-blends & fuel substitutes

- From 1st April 2022, it will be illegal to put rebated fuel into the tank of a vehicle, vessel, machine or appliance that is not allowed to use it

- If you are no longer able to use rebated fuel, you should plan to run down the fuel in your vehicle or machine to close to nil by this date. Only fully duty paid fuels & biofuels are allowable from this date

The Impact (as written by Power Electrics)

- Jumping from 11.14 pence per litre for red diesel to 57.95 pence for white diesel is a hefty and noticeable jump

- For a business using 150,000 litres of diesel per year, that’s a staggering annual increase of £70,215

NOEA Advice

- This is an issue that, for many, has gone under the radar and will be immediate concern to members

- As an association we are interested in hearing from members who will be directly affected, please do get in contact at: susan@noea.org.uk

- There is a strong sustainability argument here and one that the industry should look to balance

- Through our research, it has become clear that a straight swap to renewable energies such as wind and solar is not a viable option as, to date, they are not strong enough to cover enough of the basic needs of an event

- In the end we should all be looking to renewable fuels, in the interim we advocate for the best sustainability solutions for the planet, but also the businesses

- We would encourage members to begin to budget for these price rises

- We also advocate for open discussions within the supply chain to ensure that organisers are able to budget for the inevitable price rises as well

- We understand that this comes at a time when the industry can ill afford more erosion on its profit margins and that these price rises will fall at the door of audiences and spectators; there is a wider discussion here about the continued pressure on ticket prices

Requests to Legislators

- We are looking for the events industry to be treated similarly to the Showmen’s Guild and be exempt from having to use different fuels with crippling price rises and additional taxes

- We would expect the transition to be over five years, allowing for the industry to both budget for escalating costs, and innovate new alternatives

- These alternatives will be more reliant on renewable energies and much better for the environment

- In terms of the environmental impact within the events industry; not only are we an easy target, but one where little tangible effect can be attained, especially when set against industries with heavier fuel use

Our thanks once again to Power Electrics for the research, information and data they have shared to better articulate this issue.